Architectural Plans

Architectural Services

Contact Us

179 Edwin Road

Rainham,

Kent

ME8 0AH

Phone: 07957 350204

Email: info@architechnology.design

Company No: 12263820

Figuring out how much a building plot is really worth is tricky, and anyone buying land to build on will worry that they’re paying too much.

The problem is made worse by the limited availability of developable land, which drives up the market price for oven-ready plots and leads to the estate agents claiming that a plot’s only worth what someone is prepared to pay for it. From a seller’s point of view, that’s fine, but if you’re the buyer, figuring out what to bid, how do you figure out what a plot’s worth?

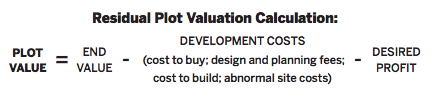

The process of valuing land is much easier than you’d think — it’s just a case of working out what kind of house a plot will support, as well as understanding its end value, and then deducting the total cost of development. The reasons why people struggle with the process a;

Unfortunately, the accuracy of this calculation depends upon subjective opinion about what the development costs will be. It means that working out your highest bid needs to be a bit of a juggling act based on the optimum mix of the following variables:

Plot valuations always start with understanding the end value of what you intend to build. The trick here is working out what the plot will support and what the local planning authority (LPA) will approve. Generally speaking, the more valuable thefinished house is, the higher the plot value will be. That said, you must have a clear understanding of the ceiling value for similar properties in the area to retain at least some level of equity and offer a reasonable sum for the plot. If you’re trying to justify the asking price for a plot, don’t get carried away with assuming you can build whatever you like. The local planning department will enforce planning policies to limit the impact of your proposal, which might restrict what can be built and constrain the plot value.

Once there’s clear understanding of what the plot can support, working out the value of the finished home is fairly straightforward – research the local market or ideally ask a qualified valuer (RICS surveyor) to value your proposals.

Valuing houses ‘off plan’, where the specification and quality of the build can’t be appreciated, isn’t an exact science so valuers might air on the side of caution. It’s therefore a good idea to check their valuation by talking to estate agents or finding out what similar properties have sold for in the local area.

These cover all the costs of building your home, from planning and design fees to finishes and everything in between. Understanding what should and shouldn’t be included, and the level of cost involved, is a challenge for even the most experienced self-builder. This is where professional builders have the edge, as they’ve got the know-how to control and reduce costs. Things to consider when calculating development costs include:

Aside from what you pay for the plot, there are a host of other expenses associated with buying land, such as the cost of conveyancing, as well as searches, surveys and investigations that might be needed to complete the due diligence process. There might also be other hidden expenses, such as dealing with covenants or paying ransom fees to gain a legal right of access to the plot.

Unless the plot comes with planning consent, you’ll need to design a house and get planning approval before anything can be built. The cost of doing this should be included within the plot valuation and, therefore, the more you spend on planning, the less you can pay for the plot. Whilst there’s nothing stopping you securing planning permission yourself to cut costs, most self-builders employ a team of professionals to make sure it’s done properly, which obviously costs more. A word of caution, whilst high-quality architecture will improve the value of the finished home and what the plot’s worth, be careful about committing to high fees without first making sure the additional expense will add the value. As well as the cost of design and planning, the planning consent will come with both conditions and obligations, which will impact on the value of the plot. Planning conditions are the smallprint of the consent and, depending on what they say, may increase the development costs, thereby negatively impacting on the plot’s value. Planning obligations are the taxes the local authority wants you to pay for the privilege of building a new home, and are likely to come in the form of a community infrastructure levy (CIL). CIL can cost thousands but fortunately self-builders can claim an exemption, provided they will live in the home for at least three years. This saving effectively raises the value of the plot, which in part explains why selfbuilders often pay more for land than builders who have no choice but to pay CIL, denting the value of the plot to them.

There are lots of ways to build a home, from using a turnkey builder to employing a project manager or taking a self-managed route. Unfortunately, some cost more than others and therefore impact on plot value differently. Build costs are driven by quality and convenience and whilst it might feel very nice to put your feet up whilst your builder gets on with the build, if this additional expense doesn’t improve the quality and value of the finished house, the plot valuation will take a hit. Controlling build costs are where developers bidding for land have the edge over self-builders. An experienced developer who knows how to build efficiently can lower construction costs and therefore improve how much they can offer for land. Fortunately, developers are hungry for profit, whereas self-builders aren’t and so there is somewhat of a natural balance between the two.

Abnormal costs are the unavoidable additional expenses associated with a plot that are not normally incurred when building a typical house. For example, bad ground might require deeper foundations, the additional cost of which become an abnormal cost. Other examples of abnormal costs are contamination, dealing with sloping sites, diverting services or making expensive service connections. Abnormal costs are extraordinary expenses, so mostly devalue what a plot’s worth. It’s therefore worth taking time to identify a plot’s problems and work out the lowest-cost solution to minimise their impact on the plot’s value.

Equity is the profit you expect to make from developing a plot. How much profit you want is a personal choice and therefore varies greatly from self-builders to developers. From a plot seller’s point of view, profit is something to avoid, as it only serves to devalue the land when included within the residual plot valuation, which explains why oven ready-plots offered for sale often look expensive. Developers want to make money and therefore consider profit as essential. They usually look to make at least 20 per cent of the project value, which significantly impacts on the plot valuation. Self-builders, however, aren’t that interested in profit as the opportunity to build a unique home is enough reward for the trouble involved. This means they can offer more for the plot, not having to include an allowance for profit within the residual plot valuation.

The unwritten rule of plot valuation is perspective — different people will have different objectives and therefore will see a different value in the land. To maximise a plot’s value, or increase what you’re prepared to pay, figure out the cost of the key variables and then work out how they influence the residual plot value. Now we’ve explained the plot valuation process, you can now get on with valuing your plot, but remember you should only be prepared to pay what it’s worth.

Source - Plotfinder Pro

Phone: 07957 350204

Email: info@architechnology.design

Company No: 12263820